May Fuller held her social security check for $41.30 on October 4, 1950. AP Photo

By John F. Di Leo –

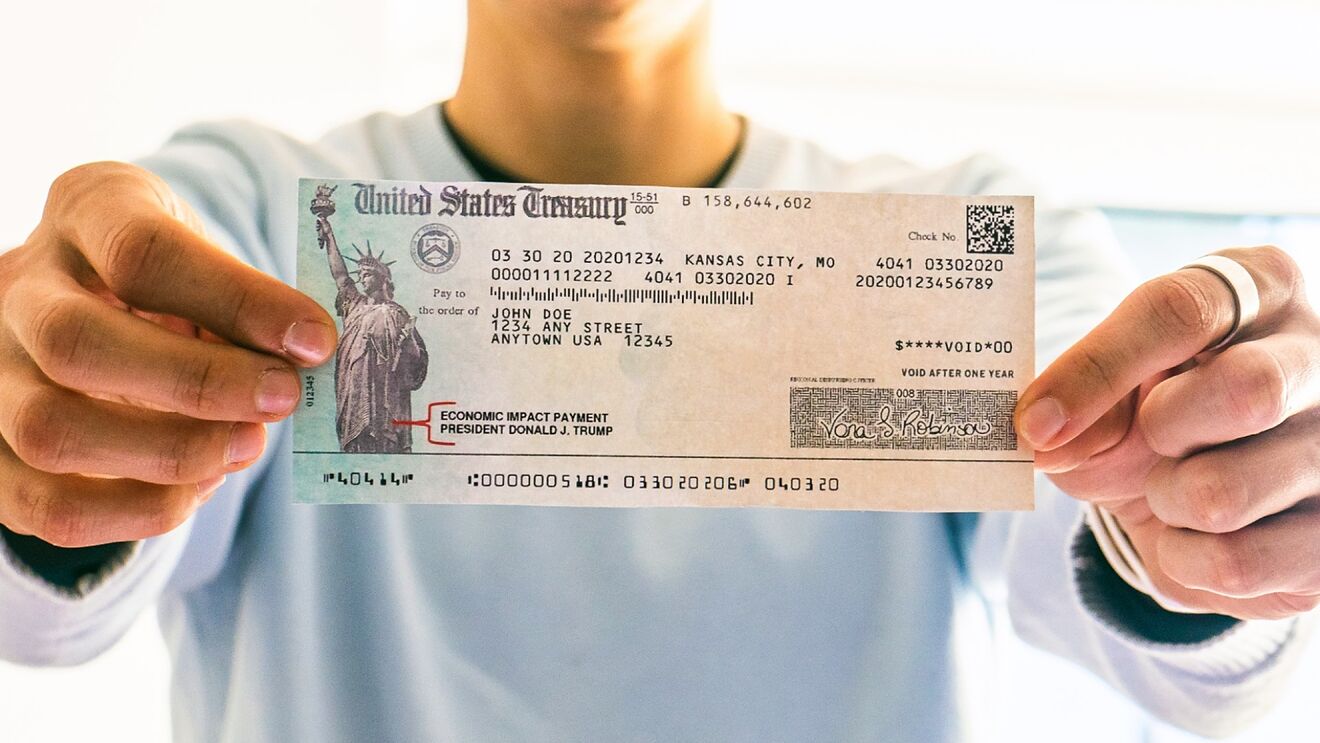

Residents of numerous states are receiving “tax rebates” and “stimulus checks” from their state governments this fall. $50 or $100 here, $200 or $300 there… it depends on the state.

But they have this much in common: these states started issuing these checks once the general election ballots were finalized, and they should all show up in voters’ bank accounts or mailboxes by Election Day.

Hmm…

The Social Security COLA (cost of living adjustment) for 2023 has also been announced. Driven by inflation, it’s going up 8.7%, the highest increase in 40 years.

And when was this “generous” increase announced? A few weeks before the general election.

Hmm…

Reasons and Results

Why all this generosity?

The states call it a tax rebate, but if they’re collecting record tax revenues, wouldn’t a tax cut make more sense than a one-time check a few weeks before the election?

Depends on what they’re really hoping to accomplish with it, perhaps.

And that Social Security COLA (which we can assume is indicative of how most entitlements will be growing in the next year) sounds really generous too, also announced just before the election.

Senior citizens traditionally have a particularly high voter turnout, by the way. Just saying.

The Cause…

All this is about inflation, of course. The country has been suffering record inflation ever since the Biden-Harris regime took office. It could be buried for a while – recessions and inflation can always be hidden temporarily – but by the second year, it became undeniable, though the Biden-Harris crowd called it “transitory” and “temporary” until they couldn’t even pull that one off with a straight face anymore.

Inflation has been fluctuating around an officially acknowledged 8% level for about six months now, the highest sustained inflation rate in forty years. And that officially acknowledged rate is the one that drives government entitlement increases (and lots of other spending increases too, incidentally… keep that in mind; we’ll get back to it later).

And the Cause of the Cause…

But why do we have this inflation in the first place? Why did it happen, and what are we doing to get it under control?

There’s a reason we haven’t had this kind of severe inflation in 40 years. Even as the US government has been spending beyond its means for a century, we still had such a vibrant economy after the implementation of President Reagan’s economic program that the country was able to grow fast enough to survive our mounting national debt. Through Republican and Democratic administrations alike, even during painful recessions like 2001 and 2009-2016, standard policies like careful management of the Federal Reserve spigot could keep inflation from going hog wild.

…until the Covid-19 shutdowns of 2020.

All of a sudden, state after state simply shut down much of their economies. While many reopened them after a while, the damage was done, and some have remained largely closed ever since. Some industries, like movie theatres and general retail, may be permanently disabled as a result (Maine, for example, virtually shut down its tourism industry two years in a row, and tourism is practically all Maine has!)

And then, once an unprecedented amount of different forms of vote fraud succeeded in putting the Biden-Harris crowd in the executive branch, the outrageous green policies of the current regime put the final nail in the coffin.

The War on Energy

Our economy runs on energy. Oil and gas, nuclear and coal, are the fundamentals of a modern developed nation. But the Biden-Harris regime declared war on them and supercharged the futile switch to solar, wind, and other similarly costly, undependable, and inefficient energy approaches.

The most immediate result of this Biden-Harris war on the economy was a doubling, then a trebling (or ‘tripling’, for those of you in Rio Linda) of the prices of automotive gasoline and truck diesel. While it’s receded a bit from its highest point a few months ago, we are today paying more than double, in some areas as much as 2.5 times, what we paid for auto and truck fuel in the final months of the Trump administration… just two short years ago!

Rarely does a single issue make all the difference… but it does here.

This one single issue – the totally artificial, massive increase in the cost of vehicle fuel – drives most other pricing in the economy.

Nothing arrives at your grocery store, your hardware store, or your front porch without being transported on a truck. The Biden-Harris regime’s conscious decision to massively increase these prices (never forget that it was intentional; they campaigned on promising this to their environmentalist-crackpot base) drives up the cost of virtually everything we buy and manufacture in America.

The food in your grocery store is trucked halfway across the country from the farm where it was grown or from the plant where it was processed. The toys and clothes in your department store crossed the country on road and rail after crossing an ocean on a ship or plane. The steel, resin, aluminum, and brass that you work with at your factory job had to get there by LTL or FTL truck. Doubling or tripling these freight costs has increased the cost of production, the cost of acquisition, and ultimately, the resale price to the customer.

Other Causes

While the regime’s decisions to shut down pipelines and restrict oil drilling across the country were the primary attack in this bombing raid against the American economy, there were others as well. Every new “stimulus” program, every new spending program, and every new stack of checks to ever larger segments of the public has increased the money supply without a corresponding level of real economic growth. And what happens when there is a higher dollar figure to represent the same amount of real wealth? Every individual dollar is instantly worth less. That’s the definition of inflation.

We have seen this regime try to illegally cancel out a trillion dollars in student loan debt. We have seen states and big cities double their minimum wage. We have seen both states and the feds raise tax rates on manufacturers and other employers. All these steps are inflationary. And all were intentional, driven by the warped economic theory of a crowd that doesn’t have the slightest idea of how an economy actually works.

So, What Does Inflation Mean to Me?

The fact is, inflation always matters, even when it’s low. Even a theoretically optimal inflation rate of 1.5% or so still does damage because if your money isn’t growing at a higher rate than that, you’re losing even with this low inflation rate. But most people don’t notice it.

Only when inflation climbs past three or four percent does the average person really notice it. Inflation has been worse than reported for decades, as companies have been forced to use trickery to camouflage price increases:

- Reducing the size of packaging without changing the price is a key culprit here: remember when ice cream and orange juice were sold in half gallons (64 ounces); now a similar package holds 52 or even 48 ounces.

- Lowering the quality to avoid price increases is another; an appliance that lasted twenty years, a generation ago, now may only last ten, because of reduced quality standards or cheaper materials. They may charge the same retail price, but you’re getting half the product if it wears out twice as quickly.

For most people, inflation doesn’t exactly mean that everything costs you more because, in fact, you just can’t afford to buy everything you used to buy.

So, what it really means, to most of us, is that we get less “life” out of the same income. If we made $50,000 before and that provided a certain lifestyle, the newly higher costs of groceries, fuel, auto repairs, theater tickets, and restaurant pricing mean that the same income allows us to buy fewer of these things. The current general average estimate is that the Biden-Harris regime is costing the average family about $6000 per year in regular spending, and on top of that, a huge amount of long-term suffering in the destruction of 401Ks, IRAs, and other retirement plans.

An economy is measured by the ability of people to afford both necessities and luxuries. The more expensive everything gets, the more of one’s money must go to necessities and the less is left over to go to luxuries.

In short, as we spend more and more on gasoline, home energy bills, and groceries, we have less and less to spend on new clothes and theater tickets, and dining out.

Now, before we start sounding greedy for wanting these things, we must remember that both luxuries and necessities employ people. Both luxuries and necessities create jobs. When people spend all their money putting gas in the car and food on the table, all the people who work at the mall, all the people who manufacture the things sold at the mall, and all the people who deliver those things, now see their livelihoods jeopardized as well.

Western civilization has thrived because the necessities have gotten cheaper and cheaper over the centuries, enabling people to afford more and more luxuries, thereby employing more and more people in a wide variety of careers with unlimited opportunities.

The Biden-Harris regime’s war on energy – along with the rest of the Democrat Congressional majority’s economically illiterate programs – have thrown our entire economic system out of whack, thoughtlessly wounding – in some cases, fatally – whole American industries that their clientele simply cannot afford anymore.

But Don’t These Announced Pay Increases Solve The Problem?

The politicians will tell you that their $200 and $300 stimulus or rebate checks will help you. They will tell you that raising your Social Security COLA by 8.7% will solve your problems. But will they?

There are three key problems with this approach:

- The market basket used to determine the CPI is hopelessly out of kilter. The real inflation rate suffered by most Americans today is closer to 16%, a doubling of the official number. So a raise of 8.7% only takes care of half the real increase; you’re still suffering half the pain even after the increase starts showing up in your bank account.

- There is always a lag in any response to inflation. Whether you’re a worker whose employer provides a cost-of-living raise every year or a retiree receiving Social Security with its COLA, these increases are always behind the curve. The payment increase for next year is based on the reported cost increase last year, so the higher inflation goes, the further behind you really are.

- Since printing more money was one of the drivers of inflation in the first place, responding to it by printing more money actually contributes to making it worse in the future. The more dollars the feds print, the less each individual dollar is worth. Not to say you can or should stop these increases, just that we need to recognize the urgency in ending the need for them, by getting inflation under control.

The government will increase what they pay in entitlements but remember since it’s based on the CPI, it’s only half what it ought to be.

And private sector employers will increase what they pay in salary, but remember, they are limited by what they can afford; if they can’t raise their prices by eight percent, they won’t be able to raise their salary by eight percent. Every company must fear losing market share, losing sales, and thus being unable to make those generous payments.

Remember, the government can just print money; it shouldn’t, but it can. Businesses can’t do that.

Then there are those of us on truly fixed incomes – the disabled, the stay-at-home moms who can’t get jobs, or the retirees with a flat pension. These groups and others like them don’t have any way of increasing their receipts; a $1000 fixed pension is just that, it doesn’t get increased when inflation trips a trigger. The recipient just loses a little bit more of his spending power, a little bit more (or maybe a lot more) of his standard of living, every month, until inflation gets back under control.

Perhaps most painfully, the tax code and the reality of inflation are not synchronized together very well. In most cases, when your employer tries to help you with a big increase, you’re pushed into a higher tax bracket, making everything worse.

The Real Solution

As the old saying goes, when you realize you’re digging yourself a hole, the first step is to stop digging.

Our country is suffering – severely – from rampant inflation, caused entirely by Democrat policies. The usual response – write more stimulus checks and rebates, and increase entitlements by the official inflation rate – will just make things worse. Rather than slowing down inflation, it will ramp it up.

The real solution is to look at what caused this nightmare and reverse course. Return to the lower tax rates of the Trump administration. Return to the free-drilling, free-fracking, free-producing policies that made America not only energy-independent but the energy capital of the world, just two years ago.

And stop rewarding economically destructive measures with massive subsidies for bad ideas and punitive regulations on what works… as the green new deal bill known as the “Inflation Reduction Act” has done.

We are watching a world-class economy implode in real-time. So much damage has been done in the past two years, and it will be a wonder if there’s anything left of this economy to turn over to the new administration after the 2024 presidential elections.

The current regime’s disastrous policies are costing the average American family between $5000 and $10,000 per year in energy and grocery inflation alone, and they hope to buy you off with a $200 check from Springfield or Trenton, or a generous-sounding COLA increase in your entitlement check that’s really only halfway to your real need.

Don’t let them get away with it.

Every Democrat elected official in the country, from the most junior Democrat Congressman to the most senior Democrat Senate Committee Chairman, shares responsibility for this disaster.

It’s election season, and early voting has begun.

It’s time to reject Raja Krishnamoorthi, Sean Casten, Mandela Barnes, Tammy Duckworth, JB Pritzker, Tony Evers, and the rest of that whole lineup of elected destroyers once and for all.

Republican politicians aren’t perfect either, but at least Republicans don’t wake up every day, dreaming of ways to destroy America’s standard of living, like today’s Democrat politicians, do.

Copyright 2022 John F. Di Leo

John F. Di Leo is a Chicagoland-based trade compliance trainer and transportation manager, writer, and actor. A one-time county chairman of the Milwaukee County Republican Party, and former president of the Ethnic American Council, he has been writing regularly for Illinois Review since 2009.

A collection of John’s Illinois Review articles about vote fraud, The Tales of Little Pavel, and his 2021 political satires about current events, Evening Soup with Basement Joe, Volumes One and Two, are available, in either paperback or eBook, only on Amazon.

Don’t miss an article! Use the free tool in the margin to sign up for Illinois Review’s free email notification service, so that you always know when we publish new content!