In a move that has stirred both concern and controversy among fiscal conservatives, Illinois Governor J.B. Pritzker recently unveiled a proposed state budget totaling a staggering $52.7 billion for the upcoming fiscal year. This proposal, representing a roughly 2% increase in state spending, earmarks significant funds towards addressing the migrant crisis, bolstering education, and investing in quantum computing. However, it is the proposed tax increases, particularly those targeting businesses and a notable hike in sports betting taxes, that have drawn sharp criticism for potentially exacerbating the state’s fiscal challenges.

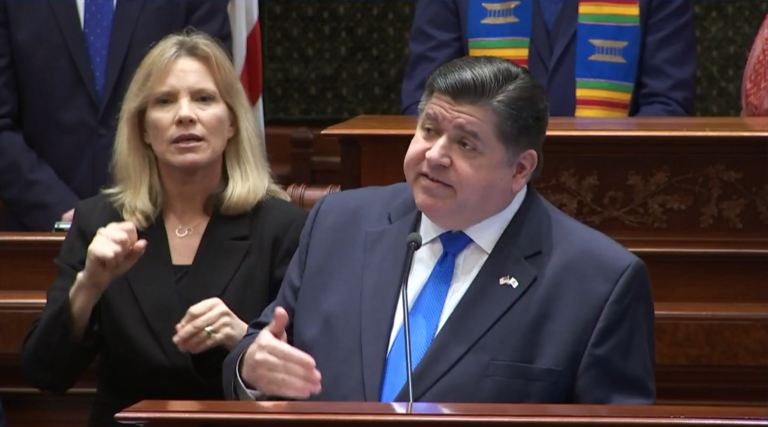

Governor Pritzker, a Democrat embarking on his second term, describes the budget as “focused and disciplined,” asserting that despite the tight financial constraints, Illinois’ fiscal house remains in order. Yet, critics argue that the proposed budget is anything but disciplined, pointing to a nearly $900 million shortfall prediction made late last year by Pritzker’s own budget office. While the deficit is reportedly smaller than anticipated, the proposed solutions, including more than doubling the sports wagering tax and capping a corporate income deduction, are seen as punitive measures that could stifle economic recovery and growth.

The budget’s allocation of $182 million for migrants, in collaboration with Cook County, has ignited a particularly fierce debate. This funding, aimed at providing “welcoming center” services, is seen by some as a prioritization of non-citizens over the needs of Illinoisans struggling to make ends meet. Senate Minority Leader John Curran, a Republican, has vocally criticized the governor’s proposal, arguing that it seeks to fund a “non-citizen welfare state” at the expense of Illinois families in need of financial relief.

Moreover, the proposed tax hikes have raised alarms within the business community, with entities such as the Chicagoland Chamber of Commerce expressing concerns over the long-term impact on small businesses still reeling from the pandemic’s economic fallout. These proposed measures, they argue, add to the existing regulatory and financial burdens, potentially hindering recovery and growth.

Despite these criticisms, Governor Pritzker’s budget does include proposals that have been met with approval, such as the permanent repeal of a 1% sales tax on groceries. This move, aimed at easing the financial burden on working families, is a rare point of consensus in an otherwise divisive budget plan. However, the broader picture painted by the budget proposal is one of increased spending and taxation, raising questions about the state’s fiscal sustainability and economic health.

Illinois’ fiscal trajectory under Governor Pritzker has been marked by a nearly $13 billion increase in the state budget over the past six years, from his first $40 billion budget in 2019 to the current $52.7 billion proposal. This surge in spending comes at a time when Illinoisans are already burdened by some of the highest state and local tax rates in the country, contributing to a troubling exodus of residents seeking more economically favorable climes. The state’s economy lags behind national averages in job growth and wage increases, with Illinois ranking 42nd and 43rd, respectively, in these critical economic indicators for 2023.

The proposed budget’s focus on education, with a $500 million investment in quantum computing technology and additional funding for K-12 education, underscores Governor Pritzker’s commitment to this sector. Yet, this commitment is juxtaposed against cuts in school scholarship tax credits for low-income families, highlighting a contentious approach to education funding.

As Illinois prepares to host the Democratic National Convention in Chicago, the spotlight on Governor Pritzker’s fiscal policies and their impact on the state’s economy will only intensify. Critics argue that the budget proposal exemplifies a broader trend of fiscal mismanagement and government overreach, prioritizing progressive agendas over economic prudence and the well-being of Illinoisans. As the state grapples with massive pension debt and a challenging economic climate, the path forward remains fraught with difficult choices. Whether Governor Pritzker’s proposed budget will steer Illinois towards fiscal folly or pave the way to prosperity is a question that will undoubtedly shape the state’s political and economic landscape in the years to come.